The Phone Call That Changed Everything: How Shaquille O’Neal’s Trust in Mark Cuban Led to His BeatBox Investment

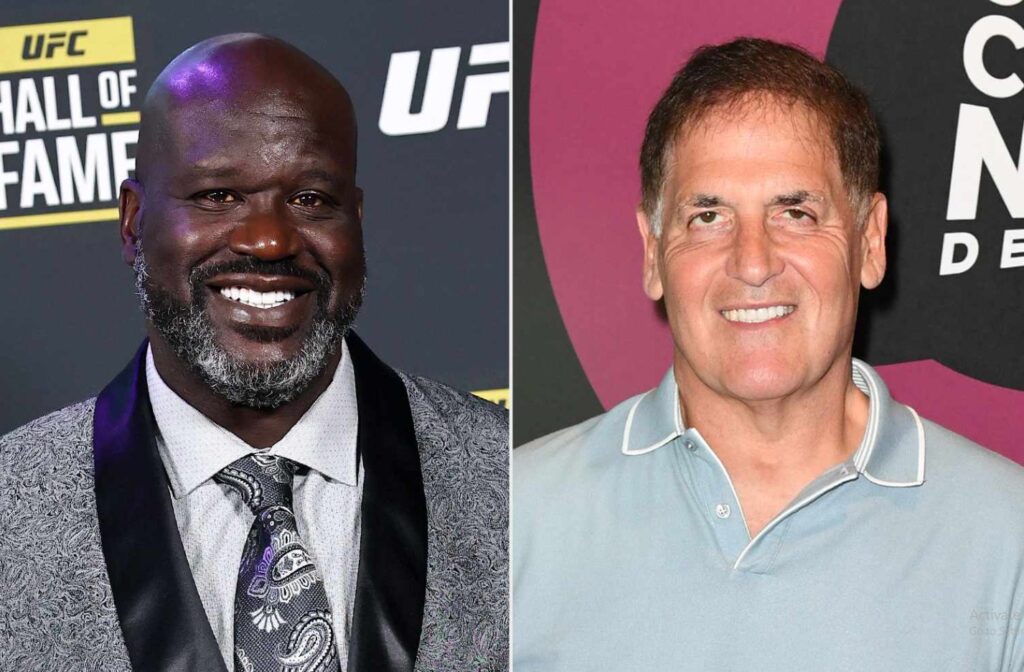

In the world of celebrity investments, few stories are as compelling as Shaquille O’Neal’s unwavering faith in Mark Cuban’s business acumen, a trust so absolute that it led to one of the most unconventional investment decisions in recent memory. The basketball legend’s investment in BeatBox, a flavored malt beverage brand, came not from extensive market research or product analysis, but from a simple phone call and an even simpler philosophy: “Whatever Mark is investing in, I’m investing in.”

This remarkable investment story began when Cuban, the billionaire owner of the Dallas Mavericks and serial entrepreneur, reached out to O’Neal with what would become a game-changing opportunity. The conversation was brief, direct, and ultimately transformative for both the beverage brand and O’Neal’s already diverse investment portfolio, demonstrating how personal relationships and trust can sometimes trump traditional due diligence in the high-stakes world of business investments.

The Genesis of an Unlikely Partnership

BeatBox Beverages, founded in 2011 by Justin Fenchel, Aimy Steadman, and Brad Schultz, had been making waves in the competitive alcoholic beverage market with its innovative approach to flavored malt beverages. The company’s colorful, party-focused branding and unique flavor profiles had already attracted attention from younger demographics, but it was the backing of high-profile investors that would truly catapult the brand into mainstream consciousness and retail success.

When Cuban first encountered BeatBox, he immediately recognized the brand’s potential to disrupt the traditional alcoholic beverage market, particularly among millennials and Gen Z consumers who were increasingly seeking alternatives to beer and traditional cocktails. The product’s vibrant packaging, social media-friendly aesthetic, and strategic positioning as a party beverage aligned perfectly with Cuban’s investment philosophy of backing companies that understand and cater to evolving consumer preferences.

O’Neal’s Investment Philosophy: Trust Over Analysis

What makes O’Neal’s investment approach particularly fascinating is his candid admission that he didn’t conduct extensive research into BeatBox before committing his capital to the venture. “I don’t need to know what the product is, I just need to know Mark is investing,” O’Neal revealed in interviews, showcasing a level of trust that is rarely seen in professional investment circles where due diligence typically involves months of market analysis, financial projections, and risk assessments.

This philosophy stems from O’Neal’s long-standing relationship with Cuban and his track record of successful investments, from his early involvement with technology companies to his more recent ventures in consumer goods and entertainment. O’Neal has witnessed firsthand Cuban’s ability to identify promising opportunities and transform them into profitable enterprises, creating a foundation of trust that transcends traditional investment protocols and market analysis.

The former NBA superstar’s approach reflects a broader trend among celebrity investors who leverage their networks and relationships to identify investment opportunities, often relying on the expertise and judgment of trusted advisors rather than conducting independent research. This strategy has proven particularly effective for O’Neal, who has built a substantial business empire spanning restaurants, real estate, technology, and consumer products through similar partnership-based investment decisions.

The BeatBox Success Story

Following the investments from both Cuban and O’Neal, BeatBox experienced explosive growth that validated their confidence in the brand’s potential. The company’s revenues skyrocketed from modest beginnings to substantial market penetration, with the brand becoming available in major retail chains across the United States and expanding its product line to include new flavors and packaging options that appealed to an increasingly diverse consumer base.

The celebrity endorsements and investments provided BeatBox with not only capital but also invaluable marketing leverage and credibility in a crowded marketplace. O’Neal’s involvement, in particular, brought significant attention to the brand through his massive social media following and his reputation as a savvy businessman who had successfully transitioned from sports to entrepreneurship with remarkable success across multiple industries.

The partnership also demonstrated the power of strategic celebrity involvement in brand building, as O’Neal’s authentic enthusiasm for the product and his genuine relationship with Cuban created compelling narratives that resonated with consumers and media alike. This organic marketing approach proved far more effective than traditional advertising campaigns, generating substantial buzz and consumer interest that translated directly into sales growth and market expansion.

Lessons in Trust-Based Investing

O’Neal’s BeatBox investment illustrates several important principles about modern celebrity investing and the role of trust in business relationships. His willingness to invest based solely on Cuban’s recommendation demonstrates the value of building strong professional relationships and the potential returns that can come from trusting experienced partners who have proven track records of success.

This approach also highlights the importance of understanding one’s own strengths and limitations as an investor, as O’Neal recognized that Cuban’s expertise in identifying and nurturing emerging brands complemented his own strengths in marketing and brand promotion. By leveraging Cuban’s analytical skills and market insights while contributing his own celebrity influence and business acumen, O’Neal was able to participate in a successful investment without necessarily having deep industry knowledge.

The success of this partnership has reinforced O’Neal’s confidence in his trust-based investment strategy and has likely influenced his approach to future opportunities, demonstrating that sometimes the most profitable investments come not from extensive analysis but from recognizing and partnering with individuals who possess complementary skills and proven judgment. This philosophy continues to guide O’Neal’s investment decisions as he builds his business empire beyond basketball, proving that strategic partnerships and mutual trust can be just as valuable as traditional market research and financial analysis in identifying winning opportunities.